In recent years, Special Purpose Acquisition Companies (SPACs) have become a popular alternative to traditional Initial Public Offerings (IPOs). Businesses are increasingly seeing the advantages of SPACs for going public, especially in uncertain market conditions.

A SPAC is a company created with the sole purpose of raising capital through an IPO to acquire or merge with an existing company. The key difference between a SPAC and a traditional IPO is the reverse merger approach used by the SPAC.

SPAC mergers can be completed in a fraction of the time it takes to go public through a traditional IPO. This is a significant advantage for businesses looking to capitalize on favorable market conditions or raise capital quickly.

One of the most attractive aspects of SPACs is that the price of the merger is negotiated upfront. In contrast, in a traditional IPO, companies must rely on market pricing, which can fluctuate based on investor sentiment and market volatility.

Many SPAC sponsors have deep industry experience and can offer strategic advice and guidance to help companies grow. This mentorship can be a valuable resource for businesses, especially for those navigating the public market for the first time.

With SPACs, companies have more flexibility in structuring deals, raising additional funds through private investment in public equity (PIPE) transactions. This flexibility is appealing for businesses needing extra capital to fund growth.

Despite the benefits, SPACs are not without challenges:

SPAC mergers can result in significant shareholder dilution, especially if additional capital is raised post-merger. Existing shareholders may see their ownership percentages decrease.

Companies entering a SPAC merger must be ready to operate as a public company within a short timeframe. This includes regulatory requirements, financial audits, and corporate governance adjustments.

Not all SPACs succeed, and the reputation of some sponsors may impact investor confidence. If a SPAC merger fails, it can lead to negative press and damage the company’s market standing.

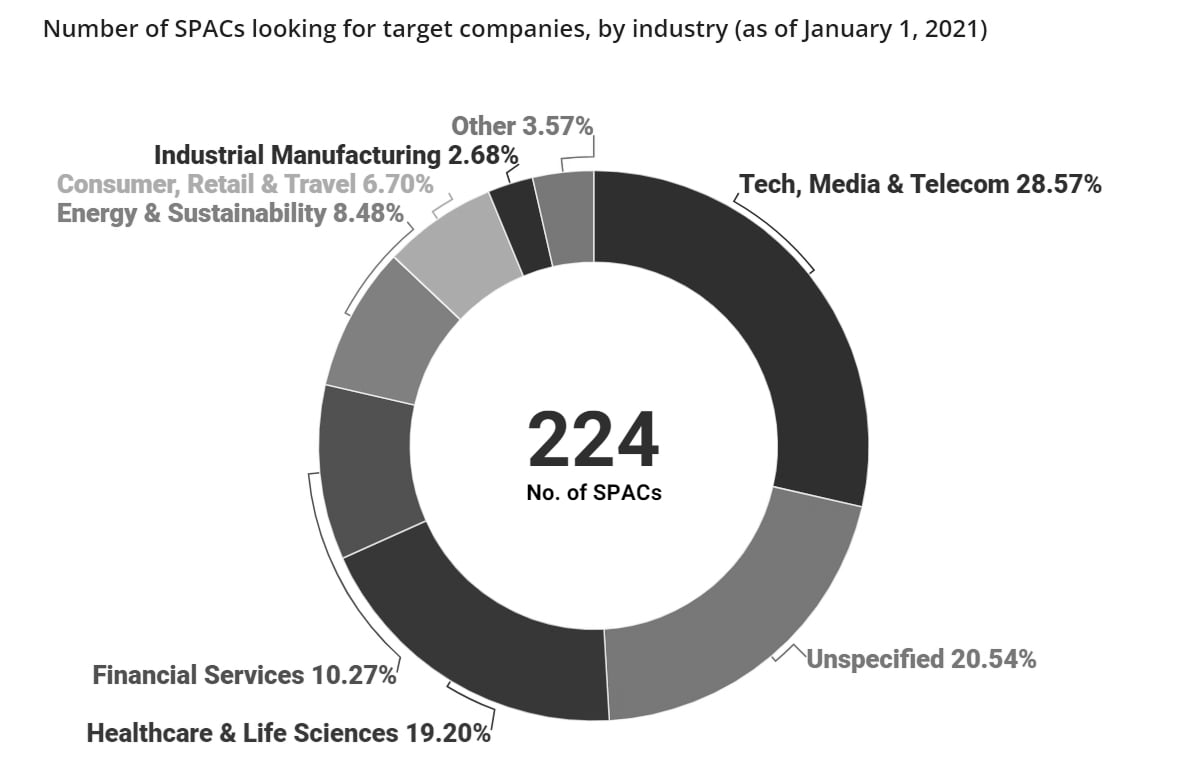

While SPACs are gaining traction across industries, certain sectors have seen more activity. These include:

These industries often benefit from fast capital injections and the strategic expertise that SPAC sponsors bring.

The rise of SPACs aligns with several industry trends, including the increased role of private equity, the availability of low-interest capital, and a focus on innovation-driven sectors. Companies aiming for rapid expansion or those operating in disruptive industries may find SPACs an attractive alternative.

| Feature | SPAC | IPO |

|---|---|---|

| Speed | Faster (3-6 months) | Slower (9-12 months) |

| Pricing | Fixed price upfront | Market-determined on IPO day |

| Capital Raising | Flexible (includes PIPE options) | Dependent on IPO size |

| Shareholder Dilution | Higher potential for dilution | Typically lower |

| Investor Access | Focused on institutional investors | Broader public market access |

Choosing between a SPAC and an IPO depends on a company’s unique needs and growth strategy. SPACs provide speed, certainty, and strategic guidance but come with challenges like dilution and public market readiness. As the market evolves, businesses must carefully weigh the pros and cons of each route.

Add comment